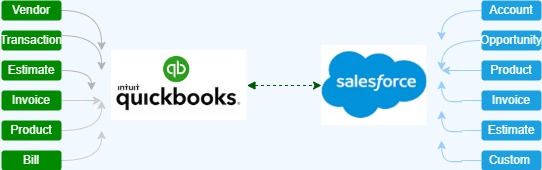

Integrating QuickBooks and Salesforce creates a powerful solution for businesses aiming to streamline operations and maximize efficiency. Combining these two platforms eliminates manual data entry, automates financial workflows, and boosts productivity. This blog explores the benefits of QuickBooks integration with Salesforce, emphasizing its transformative impact on financial management and customer relationship processes.

Benefits of QuickBooks Salesforce Integration

Businesses revolutionize operations by integrating QuickBooks and Salesforce. This integration ensures efficiency, enhances productivity, and streamlines workflows. Managing customer relationships and financial data across separate systems creates challenges. QuickBooks Salesforce integration bridges this gap seamlessly, transforming how businesses operate.

Here are the innovative benefits of this integration:

1. Streamline Financial Processes Effortlessly

QuickBooks and Salesforce synchronization guarantees seamless financial and customer data flow. This integration reduces errors and eliminates redundant data entry. Salesforce provides sales teams with direct access to financial data, enabling faster and more effective decision-making.

Real-time updates between platforms allow businesses to monitor sales transactions, payments, and invoices without switching systems. Consequently, operational efficiency improves, and resources are redirected to higher-value tasks.

Key Benefits of Streamlining Financial Processes:

1. Automated syncing of invoices and payment records

2.Faster reconciliation of accounts

3.Reduced manual errors in financial documentation

2. Enhance Visibility for Decision-Making

Teams are given greater visibility into important financial KPIs with the integration of QuickBooks and Salesforce. Sales and finance teams may work together easily by accessing client payment history or unpaid bills in Salesforce.

Businesses can access unified dashboards when they connect both tools. These dashboards give a clear image of customer profitability, revenue trends, and sales performance. Effective data analysis by decision-makers results in better corporate outcomes and well-informed plans.

Why Enhanced Visibility Matters:

1.Improved collaboration between sales and finance teams

2.Better insights into customer behavior and payment trends

3.Accurate forecasting based on real-time data

3. Accelerate Cash Flow Management

The integration of Salesforce and QuickBooks simplifies cash flow management. It automates invoicing and payment tracking, reducing payment receipt delays. Teams access past-due accounts instantly, send timely reminders, and ensure faster cash inflows.

Streamlined cash flow processes enhance financial planning. Businesses deploy resources confidently, achieve sustained growth, and benefit from reduced delays and automated tracking.

Benefits of Cash Flow Management:

1.Faster payment processing and reduced delays

2.Simplified financial planning for business expansion

3.Consistent tracking of overdue invoices

4. Boost Operational Productivity

Businesses can increase efficiency by automating repetitive operations by combining Salesforce and QuickBooks. For instance, creating invoices straight from Salesforce reduces duplication of effort and saves time.

Teams can concentrate on fostering client connections and increasing sales thanks to automation. A unified system also makes it easier to manage two different tools, which enhances the user experience in general.

Key Benefits for Productivity:

1.Time-saving automation of manual tasks

2.Streamlined workflows for better customer interactions

3.Enhanced user satisfaction with integrated tools

5. Simplify Tax Preparation and Compliance

Tax management is made easier by QuickBooks Salesforce connectivity, which guarantees precise record-keeping. Errors during tax season are decreased when income, expenses, and invoices are automatically tracked.

Businesses are better able to adhere to tax laws when financial data flows smoothly. Additionally, this link facilitates the creation of comprehensive financial reports, guaranteeing openness during audits or reviews.

Why Simplifying Tax Management Helps:

1.Reduced risk of financial discrepancies

2.Accurate and reliable financial reporting

3.Easier compliance with tax regulations

6. Improve Customer Relationships

By giving sales teams useful financial details, integration makes it possible to have individualized customer engagements. For example, knowing a customer’s past purchases or payment habits enables customized communication.

Improved understanding of consumer behavior enables sales teams to provide pertinent goods and services. Long-term revenue growth and increased client loyalty are the results of forging closer partnerships.

Benefits for Customer Relationships:

1.Personalized communication based on financial data

2.Better understanding of customer needs and preferences

3.Enhanced customer satisfaction and retention rates

The benefits of QuickBooks integration with salesforce extend beyond financial automation. By optimizing processes, businesses enhance productivity, improve decision-making, and strengthen customer relationships. Adopting this integration empowers organizations to manage their operations effectively and achieve sustainable growth. Embrace the change and experience the transformative impact on your business with best salesforce consultant.

For more information and details, contact us or book a demo with us at Logic Mount today.

To get more details on salesforce integration about its benefits, features and process, checkout the blog below:

What is Salesforce Development and Integration ? – Logic Mount

Check out our other blogs on other websites:

A Comprehensive Guide to Salesforce QuickBooks Integration – Substack

Leave a Comment