Effective financial management is crucial for accounting firms aiming to achieve seamless operations. Integrating Salesforce with QuickBooks revolutionizes financial workflows, offering automation and efficiency. QuickBooks integration helps accounting professionals streamline processes, eliminate manual data entry, and reduce errors. This integration allows businesses to focus on strategic goals while achieving higher productivity. With Salesforce QuickBooks integration, accountants gain real-time financial insights, automate routine tasks, and maintain accurate records effortlessly. This solution transforms how accounting firms operate, creating an unparalleled advantage.

Understanding the Power of QuickBooks Integration

QuickBooks integration helps accounting firms ensure a smooth connection between Salesforce and their financial procedures. This integration reduces operational bottlenecks and saves time by automating key processes. Accountants can synchronize client records, invoices, and payments in real-time, enhancing data accuracy. By using this strategy, companies experience fewer financial reporting delays, enabling more proactive decision-making.

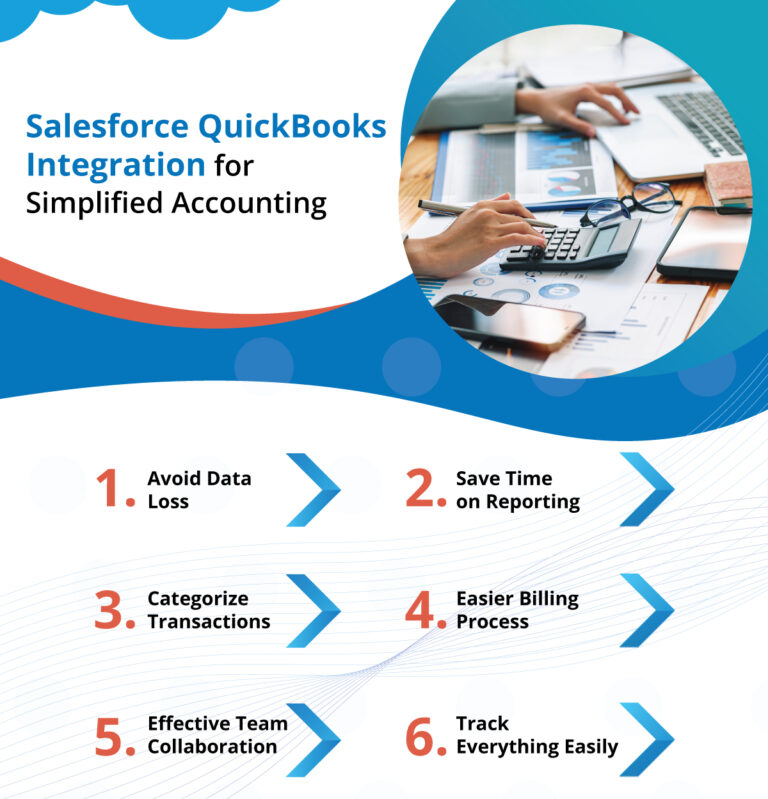

Benefits of Salesforce QuickBooks Integration for Accounting

1. Automate Data Synchronization:

Updating financial records by hand takes time and leads to errors. When Salesforce and QuickBooks integrate, customer information, invoices, and transactions synchronize instantly. This process eliminates inconsistencies, ensuring all data stays consistent. Instead of wasting time on repetitive tasks, accountants can focus on crucial financial planning. QuickBooks integration helps accounting professionals automate this synchronization, improving efficiency and accuracy across the board.

~Updates between systems in real time.

~Precise reporting that doesn’t require manual reconciliation.

~Quicker invoicing and payment processing.

2. Enhance Workflow Efficiency:

A smooth data flow improves operational effectiveness. Accountants may concentrate on consulting services thanks to this integration, which removes the need for redundant data entry. Automation streamlines processes like creating invoices and keeping track of spending. Simplified processes encourage teamwork, which leads to a cohesive approach to financial management.

~Automate the creation of invoices and billing.

~Easily keep track of your spending.

~Workload can be decreased by synchronizing records.

3. Improve Financial Reporting Accuracy:

For making decisions, accurate financial reporting is essential. The Salesforce QuickBooks integration helps accounting firms gain real-time financial data, enabling better insights. Accountants can monitor performance, spot patterns, and produce error-free reports using customizable dashboards. Consistent data availability strengthens compliance and improves audit procedures.

~Create financial reports in real time.

~Synced data reduces reporting mistakes.

~Keep an eye on cash flow with improved visibility.

4. Strengthen Client Relationships:

Client trust is increased when billing and payment procedures run smoothly. Prompt invoice generation and payment tracking are guaranteed by integration. Accountants can give their clients better service if their payment histories and conversation records are synced. This enhanced communication creates enduring bonds that increase customer happiness and retention.

~Set up automated payment reminders to ensure prompt follow-up.

~For improved administration, centralize client communications.

~Consolidated data can be used to improve service personalization.

5. Boost Scalability for Growing Firms:

Scalable solutions are necessary for expanding accounting businesses to manage growing workloads. As your company expands, Salesforce QuickBooks connection increases with ease. It adjusts to shifting needs by taking on new customers and growing its financial operations. Businesses may take on more work because to this scalability without sacrificing accuracy or efficiency.

~Flexibility in the face of growing data quantities.

~Simplified procedures for bigger groups.

~Support for various tax laws and currencies.

Best Practices for Optimizing Integration

1.Regularly review and update data mappings.

2.Set automated alerts for any sync failures.

3.Leverage advanced reporting features for insights.

4.Customize workflows to match specific business requirements.

5.Maintain a backup to safeguard critical financial data.

Salesforce QuickBooks integration transforms accounting businesses by enhancing efficiency, accuracy, and scalability. It automates routine processes, ensuring data consistency and improving financial reporting. By adopting this solution, accounting firms can focus on strategic goals and foster better client relationships. Embrace the power of integration to revolutionize your financial workflows and unlock growth opportunities. Begin your journey with best salesforce consultant to smarter business management today!

For more information and details, contact us or book a demo with us at Logic Mount today.

To get more details on salesforce integration about its benefits, features and process, checkout the blog below:

What is Salesforce Development and Integration ? – Logic Mount

Check out our other blogs on other websites:

A Comprehensive Guide to Salesforce QuickBooks Integration – Substack